** Scroll to the bottom if you’d like to skip right to the $ amounts **

“But how much does it actually cost?”

The most frequent questions we field at Citron insurance are around pricing on insurance policies in Canada.

“Can you get a deal on insurance?” “How do I pay the best rate?” “What is the difference between the different companies?”

The short answer is “It depends!”.

It depends on what kind of product you are buying, on the length of the term, the value of the policy, your age, your gender, and your health rating.

Let’s get into it:

Product Type

In general, term policies are much cheaper than permanent policies. This is because of the risk that the insurance company is underwriting. If they are only covering 10 years, the likelihood is that they will not have to pay out the death benefit. For permanent policies, there is a guaranteed payout one day and the costs adjust accordingly.

Term Length

Simply put, the shorter the term, the less expensive the premiums will be. As we age, mortality risk increases. If you are covering 10 years from 35 – 45, the risk is much lower than than the 45 to 55 years. If you’re purchasing a 20 year product (35-55) the premiums will be higher because they are covering riskier years. This difference becomes more exaggerated the older you become.

Age

We mentioned mortality risk in the last segment. It is a fact of life that younger people are typically healthier than older people. Insurance companies (and the Canadian Government) have charts that tell us exactly what percentage of the population dies in any given age group each year. As we get older, this percentage increases. In other words, the older we get higher the likelihood of death. This number is called mortality risk. The greater the risk, the more expensive the insurance policy. Therefore younger people get better rates on their premiums.

Face Value of the Policy

Like any product the more you buy the more expensive it becomes. That 72” TV is going to be more expensive than the 54”. It’s the exact same thing with insurance. if you buy $1Million, it will be roughly half as expensive as $2Million. Like other products, you do tend to get a discount when you buy in bulk though. So the cost per thousand usually decreases the higher the face value.

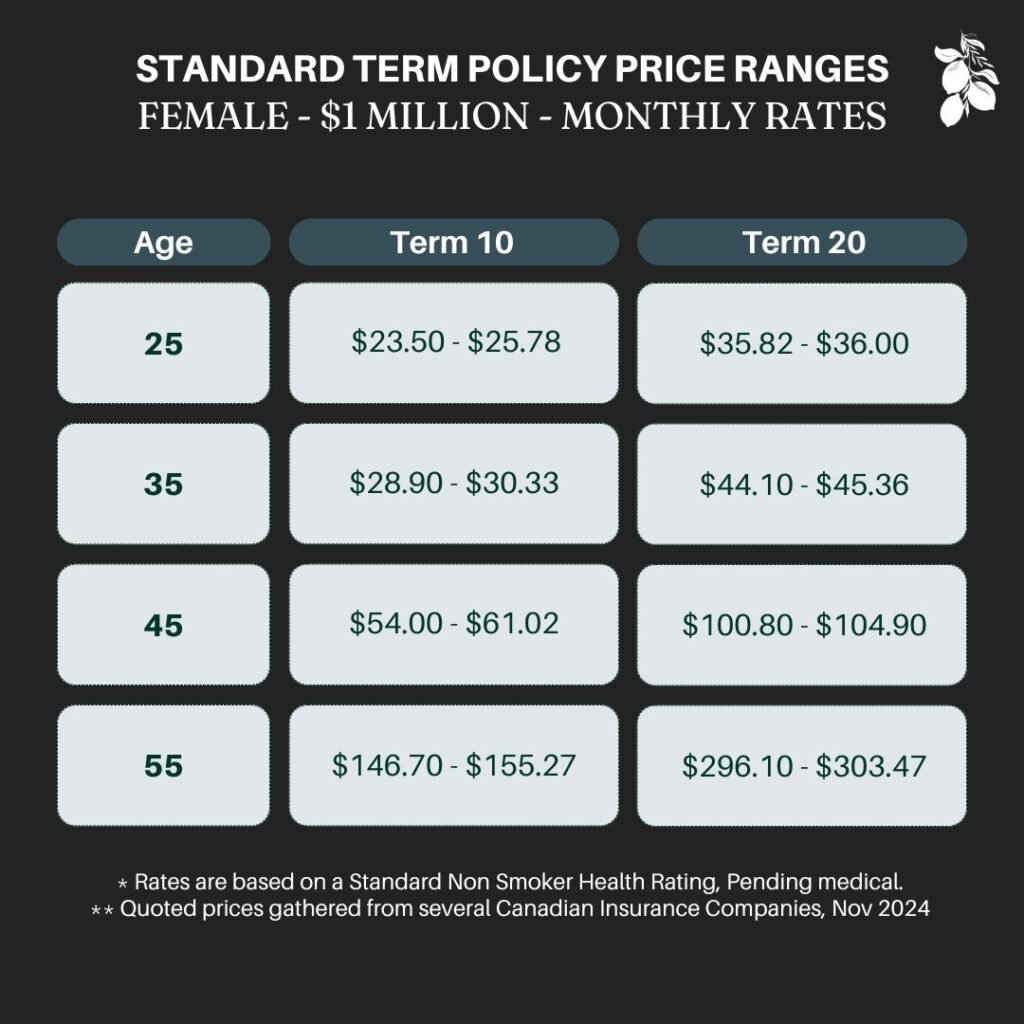

Gender

Sorry, Men. But in this area, the ladies have you beat. On average, men die younger than women. It is a significant enough difference that insurance policies are divided into a completely separate category based on your gender. Men have a higher mortality risk and pay more in premiums for it.

Health Rating, Lifestyle, and Smoking Status:

This is where it gets a bit more complicated, but there are some heuristics that we can follow. The most common is smoking status. If you are a smoker, you have a higher mortality risk, your premiums are much higher. Some other factors that impact your health status include: your weight, pre-existing medical conditions, and your family history. Lifestyle matters as well; Excessive alcohol use or a history of drug use will impact your health rating. As will risky activities such as sky diving and back-country skiing.

The Different Insurance Companies

Generally speaking, most insurance companies in Canada have similar rates. They underwrite policies using the same information, and their underwriters are all great at their jobs. Sometimes, for “business” purposes, insurance companies will offer a deal or try and target a specific market with better rates than their competitors. You can save a little bit by taking advantage of one of these promotions, but in the long run, it is usually not a significant cost savings. A penny saved is a penny earned however, and we always try to get our clients the most competitive rates possible. There are usually other more important factors, however when choosing a carrier (insurance company).

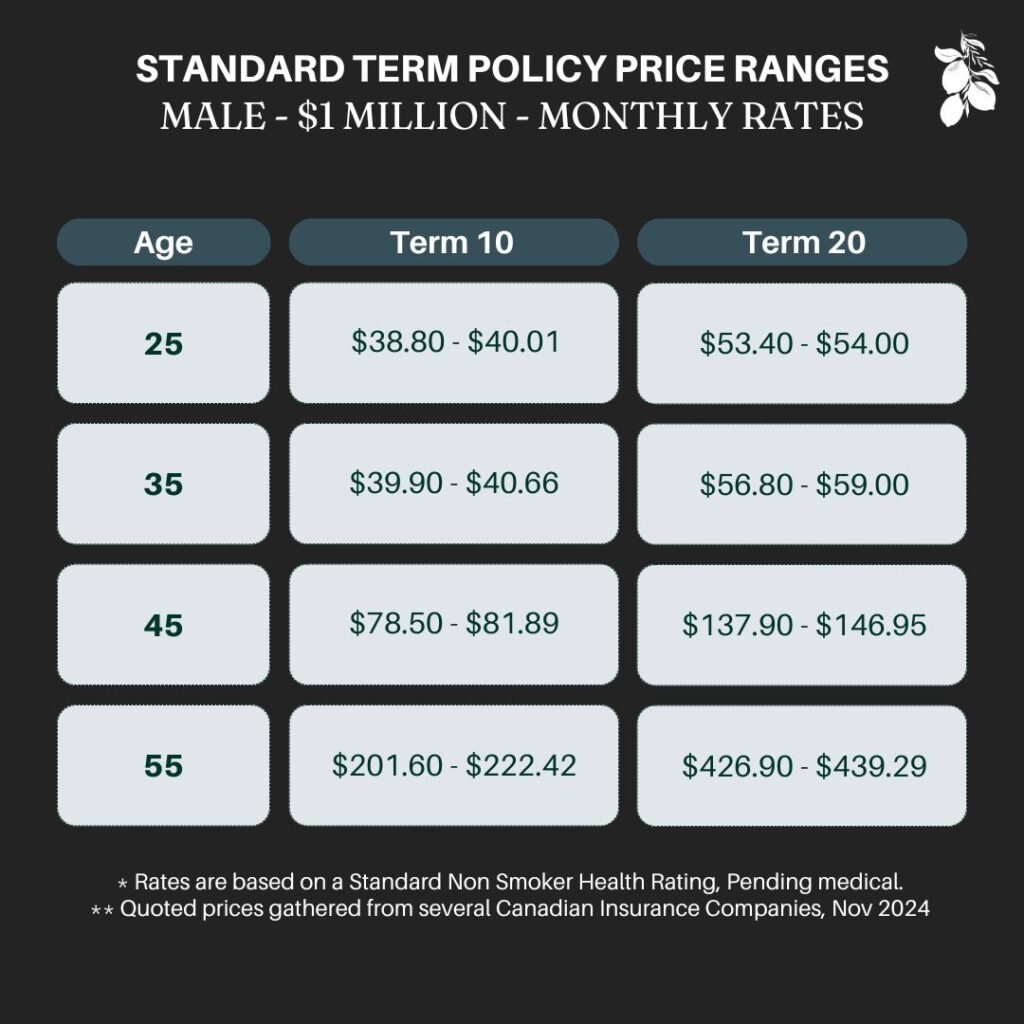

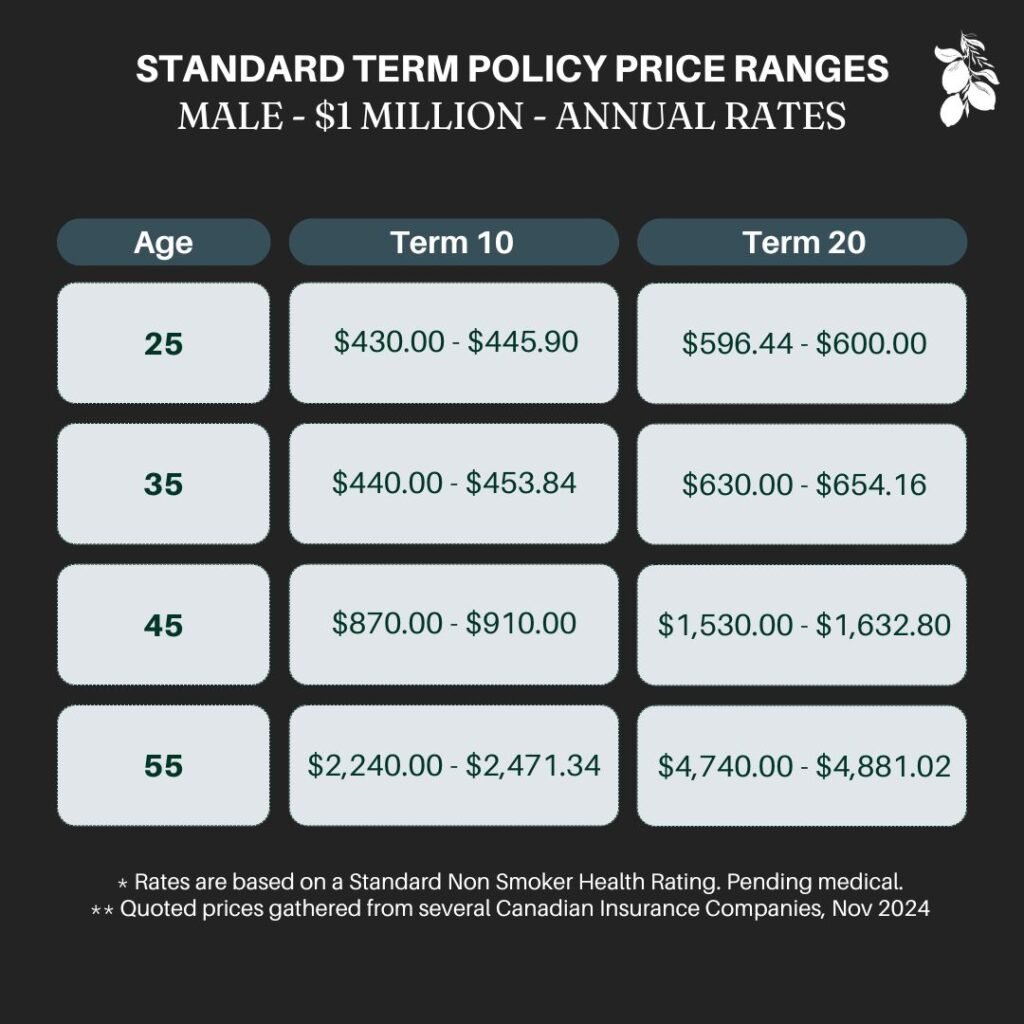

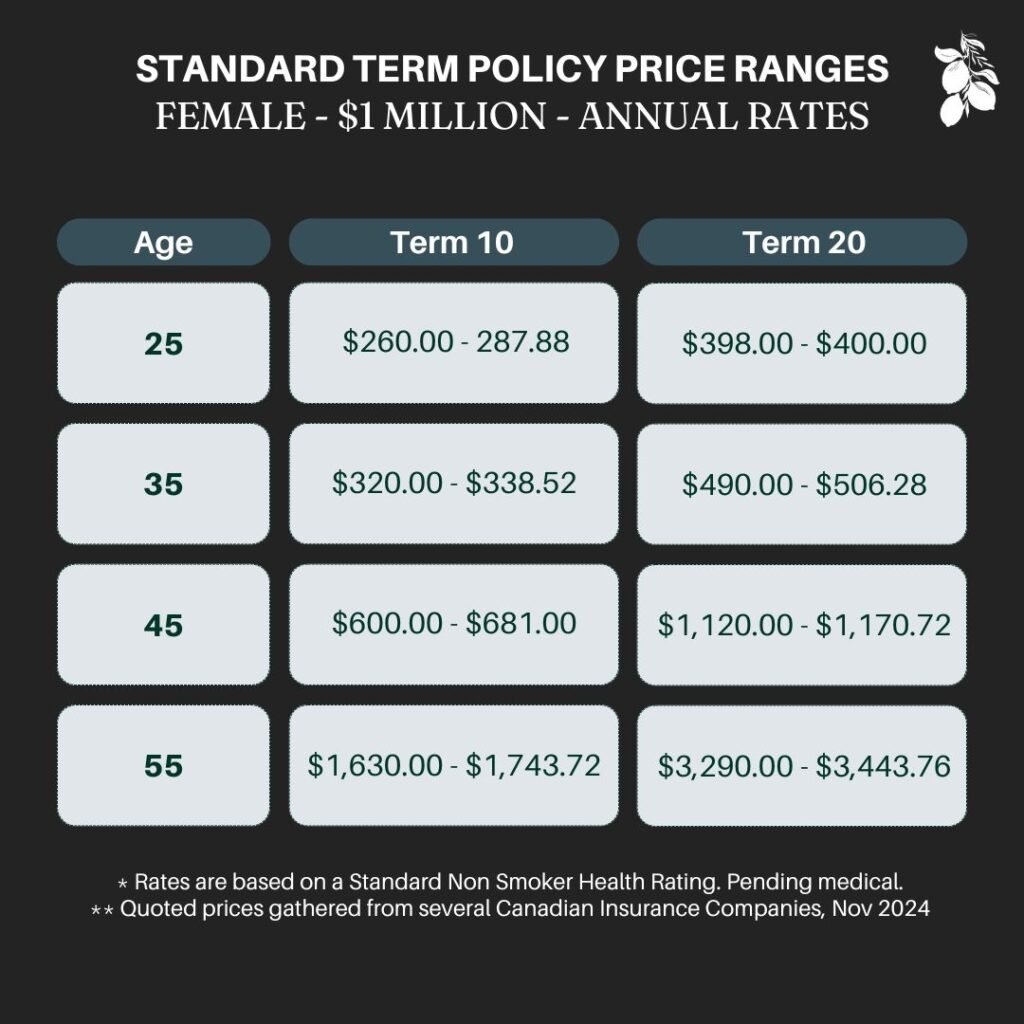

The Costs in Four Charts

All that being said, what are the actual dollars and cents? Here are some charts outlining a typical Term policy we might recommend to our clients. We’ll use $1 million as the face amount with a standard health rating to try and limit some of the variables. If the number is too much or too little, remember that the pricing scales roughly linearly with the face value of the policy.

So here they are, four charts outlining the costs:

So there you have it, “It depends!”. For $1M of coverage you could pay $25 a month if you’re a young and healthy woman. It goes up from there, (or down if you wanted less coverage).

Note how the price increases quite a bit for policies that cover years in your 50s & 60s. The premiums are relatively flat until ~age 40 but begin to increase quite significantly after the big 4-0.

You can also see in these tables however, that for a young and healthy 35-year-old, you can get a ton of coverage for less than $10 a week.

Have questions, or want more information? As always, you can reach out to Citron insurance and we’d be happy to help point you in the right direction.

Leave a Reply